It is not so long ago, I looked at the predictions of the larger brokerage houses for the market in 2020. After a stunning 2019, most analysts expected a relative calm market in 2020 with a return of between 2% and 6%, dividends included.

By definition, only a few (if any at all) economists were ready for the Black Swan event of 2020: the coronavirus. It is probably less the coronavirus which is by some medicals called a severe flu, but rather the hype and news flow around it. The panic coming with the virus, closes schools, disrupts supply chains, cancels larger industry and sport events, put entire regions into quarantine and makes the consumer highly uncertain. It will push leveraged businesses probably to extremes.

There are two issues which need to be understood:

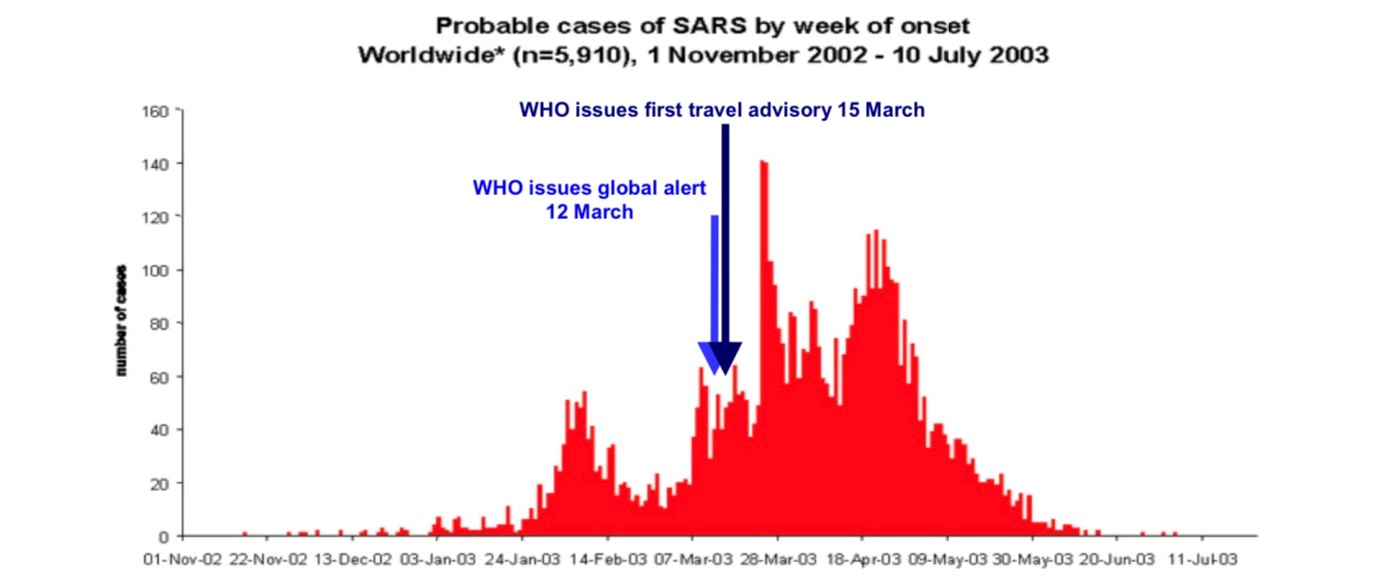

1-Will the virus´s propagation slow down when summer starts in the northern hemisphere? Hopes go so far to expect the same behaviour than the SARS virus which nearly disappeared during the 2003 summer period.

2-Is this coronavirus ready to mutate and increase the death rate (for now the death rate is quoted between 1.5% and 2%)?

Although all this keeps the normal person busy, what is more striking, is the impact this virus will have on our global economies. Obviously, the tourist and transport sector will be hit the worst. Shares like EasyJet have corrected some 30% over the last 3 weeks. Major indices like the Dow Jones Industrial have corrected some 14%, the export tainted German DAX has seen a correction of more than 16% since February 2020. The 10-year US treasury-yield is at a new low of 1.075%. I do not remember to have seen yields at these levels during my lifetime. Fear seems to be the new greed.

Some investment houses start to downgrade GDP growth from 2.8% in 2020 down to 2.5%. To give a reference, the last time we have seen corrections of these magnitudes were during the crisis in 2008/2009.

It is probably hard to escape a recession, and we will have to focus on which kind of recession we should expect. Will it be a mild recession with some corrections of 15%/25% in earnings or will we see a correction with some 35%/45% earnings break-in?

Strangely, I do not feel that the market correction is over, simply because there are only limited positives when it comes to controlling the coronavirus Cov-19. Contrary to popular believes, propagation statistics and controls based on blood analysis are few and rare and are slow. Many people might not even realise what the difference is between a regular flu and a mild-symptom-coronavirus infection.

However, what strikes me most, is the popular hype involved with this disease and the economic consequences. Please do not get me wrong. I am aware that the human tragedy related to deaths is terrible. However, disruptions caused by the coronavirus outbreak that originated in China and is now spreading through the rest of the world are driving the global economy closer to a recession. And this might present the real danger for our societies.

I certainly have no crystal ball, but this economic showdown stresses the weaknesses of the individual countries even more; be it the dependence of the world on supply from Chinese companies, the debt roll-over of Italian sovereign debt, and the love of the investment world with high yielding high-risk debt instruments. These facts make investors and companies alike, highly exposed to this new virus and crisis.

The OECD sounded the alarm that there is a possibility that global economic growth could halve this year: it lowered its growth forecast from 2.9% to 2.4%, a contraction which we saw last in 2008/2009.

It even quoted that a ”longer lasting and more intensive coronavirus outbreak “could slash growth to 1.5% in growth!

Probably the averted reader knows that a global economic growth of 2% is equal with a global depression.

Will the floodgates of the Central banks help us to overcome this crisis? As Paul Donovan, chief economist from UBS says, currently people do act with instinct rather with facts. Even if Central Banks cannot cure the virus, cannot persuade people to go shopping, and should not care that the S&P is down, they still may help. Clearly if there are cash flow problems, then Central Banks can help. They exist to control credit and liquidity problems. Expectations for fiscal stimulus should further support our economies.

What do I expect to happen next?

Fear has not yet changed the behaviour of the consumer in the US, one of the largest markets in the world. We estimate that this is only a question of time, and probably by mid-March 2020 this fear will have gripped the US as well. It was striking how after a recent speech by President Trump on the coronavirus, the searches skyrocketed on Google for the coronavirus infection. We do not know how long the fear will be the number one topic in the US, but surely the impact will be felt straight away by markets. We expect some more dark clouds and sell-offs over the next 6 weeks to come as the US consumer will feel the full might of this hype. We sincerely hope that contrary to extreme worst-case scenarios by the British government, which was leaked to the press, that far less than 500 000 people will die of this virus. The markets and the world have not yet fully understood the impact, and thus we continue to see these wild assumptions.

Today, the fear is fear.