As the cycle gets longer and as trade war symptoms are abundant, many investors believe it is now time to sell and go away.

We fully understand that cash positions have risen as the risk has risen. It is not only the peaking profitability of corporates which has moved closer, but also a slowdown in globalisation. For the advert reader, the peak has not yet happened, but why do hedge fund managers like Paul Tudor Jones comment that stock market and bond yields are set for a crazy rise in the next months?

Only yesterday, Jones mentioned that the next economic downturn confronted by the US could be an ugly one.

In order to fully make sense of his comments, we need to be aware that stock markets have the tendency to go up exponentially before we see a collapse in economic growth. This has been like that before any past recessions. Informed investors smell the approach of winter in summer; more asset managers launch long-short vehicles, and private equity investors try to get their close as soon as possible. So why do we argue here stock investors should not sell yet?

According to our observations we are not yet there as our factual signs do not tell us that any recession is imminent. What do we have to see to be convinced that a recession is close?

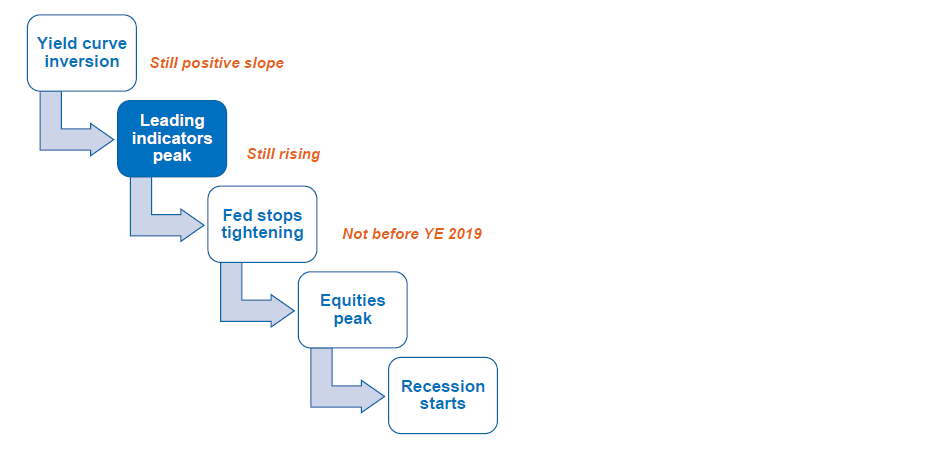

CANDRIAM Investors Group (an asset management group) has put together an interesting way to time the next recession:

CANDRIAM states that 3 conditions need to be fulfilled for an equity peak and a subsequent recession:

1) The yield curve has to invert: Needless to stress that the yield curve is flattening as the FED increases short term rates and long-term term rates are still somehow coy. They touched briefly the 3.1% in order to fall back.

2) Leading indicators peak: this is more difficult to predict than we only know in a few months if we have seen an absolute peak or a relative peak in terms of Purchasing Managers Indices (PMI) but also in terms of investor sentiment

3) The FED stops tightening: here we were told by the FED that they consider four hikes in 2018; this is far away from stopping the tightening.

In other words, in the absence of abnormal cyclical risk, our view is to stick with your equity investments. What would I do with my credits and sovereigns? Clearly, I would lighten up considerably. Although inflation is not yet a major player in the perception of most investors, the continuous wage increase, the rebound in commodities will sooner or later lead to a stronger move of inflation. It is difficult to say if this happens over the next 6 months or the next 12 months. It will eventually happen…

Let us conclude: Continue to stay with equities, US small and mid-caps, but also cyclical values in Europe and in the US. We believe Emerging Market equities do offer an interesting entry point. Use the indicators above to eventually trim your equity holding in due course. And do not get us wrong: a recession will come, but do not leave the party at 9.00 pm since it should go on until midnight. Last but not least, be aware that there might be some party crashing from a renewed US trade policy.